Neuroeconomics: Making Big and Small Decisions

- Reviewed21 Nov 2018

- Author Michael W. Richardson

- Source BrainFacts/SfN

What was the last thing you bought? Maybe it was a cup of coffee, or a salad for lunch. Did you think about the relative costs associated with all of the options? Is it worth the extra couple of dollars to get the fancy espresso drink with extra frothed milk, or should you get the regular coffee and pocket the change? And are you really hungry enough to justify getting the donut too?

We are constantly making financial decisions for ourselves, and they range from the small and mundane to the massive and life-changing. Beyond your morning coffee, you may be worrying about saving for retirement, or thinking hard about your next major purchase. These everyday decisions, multiplied by billions of people, are the basis of the worldwide economy. The basis for these decisions is a significant question for both economists and neuroscientists. In recent years, these groups have begun collaborating in a new field, called “neuroeconomics,” which seeks to explain the cognitive processes behind economic decisions.

According to Scott Huettel, professor of psychology and neuroscience at Duke University, neuroscience provides unique perspectives on a number of topics, from effective advertising to the costs of drug addiction. “In any of these cases, there’s a real world problem that people have cared about for a long time,” says Huettel. “And in every case, neuroscience has provided new insights.”

A driving force behind the modern economy is the belief that individuals make rational purchasing decisions. However, many economic decisions are irrational. Our actions are governed by biases and contradictory impulses that make even simple economic transactions less than rational. Neuroeconomics is especially interested in those situations where choices are less clear-cut or rational, and involve unknown (or unacknowledged) factors and risk - something economics has had a hard time explaining, says Huettel.

“One of the problems with behavioral economics is that there are no real underlying theory to why people make all of those unexpected decisions. Neuroscience generates theories about the underlying mechanisms that lead to many different economic biases. It helps provide meaning to the anomalies in economic behavior.”

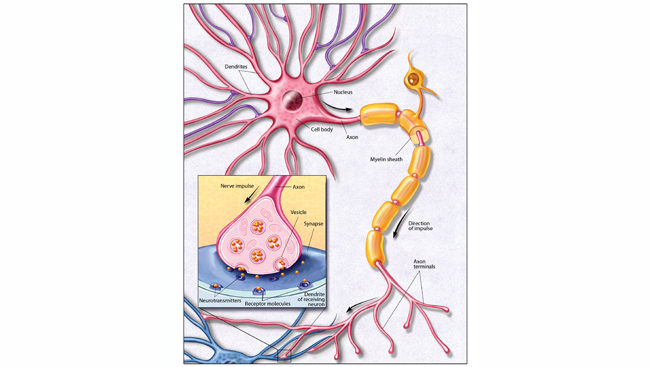

To learn more about these decisions, scientists have measured brain activity as people complete economic tasks – for example, running brain scans as people play a simple double-or-nothing game. When a player decides to risk it all to double their winnings, activity increases in a part of the brain called the insular cortex. Scientists hypothesize that networks of the insular cortex interact with other brain areas, including parts of the limbic system that function in learning, memory and emotion, to help the player picture the negative consequences of taking such a risk. Suddenly risking a mortgage payment at the blackjack table doesn’t look so appealing.

Scientists have also discovered that our hormones play a role in economic decisions. In one case, some participants in an investment game were given a dose of oxytocin, a hormone long associated with social bonding. Those who received the oxytocin boost were more trusting with their money and invested larger amounts with a broker. However, if they made investments through a computer program rather than a person, the oxytocin had no effect on their investment strategy. These results suggest that social and neurobiological factors interact to play a role in such decisions; and these kinds of effects are at the heart of many economic decisions. More research in this area could lead to more rational investment strategies.

Another study of male stock traders looked at levels of the hormones testosterone and cortisol. Researchers took saliva samples from a small group of traders every day during a workweek, before and after the bulk of their work was done. On days when the traders had higher testos-terone levels than average, they took larger risks. However, higher-than-average levels of cortisol (a hormone associated with stress) correlated with risk-averse behavior. With millions of dollars on the line, hormones could be making the difference between a good day at the market and a very bad one.

But it’s not just hormones that affect the way you choose to spend money. Even at the level of the neuron, your brain is simply better at handling small numbers than large ones. Even though we agonized over a couple dollars added to our coffee order earlier, if you went to negotiate the price of a car, an extra few hundred dollars might seem like a small amount. Psychologists have known about this affect for a long time, but neuroscience has shown that the precision of information neurons can encode decreases as the numbers increase proportionally.

Research into reward pathways and the way your brain promotes impulsive behavior can help to prevent your making purchases and decisions you'd regret.

There are other, more practical ways that neuroscience findings can affect your purchasing decisions. For advertisers, it’s advantageous to use measurable brain reactions to craft effective messaging - a discipline known as “neuromarketing.” Some firms are now using brain imaging technologies like fMRI and EEG to measure how the brains of prospective buyers respond to ads in real time. Beyond that, they’ll monitor other physiological reactions to their ads that are associated with brain functions - pupil dilation, eye movements, skin conduction, and other involuntary bodily reactions. While before they may have relied on the subjective feedback from focus groups, there’s more and more desire to get objective biological feedback as well in order to craft effective advertising. This isn’t just being used to sell shampoo though - researchers are using the same tools to help make public service announcements more effective too.

Neuroscience can change our current thoughts about the economy in many other ways. Research on autism spectrum disorders is discovering promising treatments, but also revealing opportunities for workplaces to employ the unique abilities of neurodiverse people. Research into reward pathways and the way your brain promotes impulsive behavior can help to prevent your making purchases and decisions you'd regret. Scientists are also studying unconscious biases and discrimination to help eliminate negative prejudices in hiring and employment. These are only a few of the practical applications of neuroscience, and more are anticipated. Soon, neuroscience may have all the tools needed to design a better, and more inclusive, economic system.

This article was adapted from the 8th edition of Brain Facts by Michael Richardson.

CONTENT PROVIDED BY

BrainFacts/SfN

References

Camerer, C., Loewenstein, G., & Prelec, D. (2005). Neuroeconomics: How Neuroscience Can Inform Economics. Journal of Economic Literature,43(1), 9-64. doi:10.1257/0022051053737843

Camerer, C. (2008). Neuroeconomics: Opening the Gray Box. Neuron,60(3), 416-419. doi:10.1016/j.neuron.2008.10.027

Falk, E. B., O’Donnell, M. B., Tompson, S., Gonzalez, R., Cin, S. D., Strecher, V., . . . An, L. (2015). Functional brain imaging predicts public health campaign success. Social Cognitive and Affective Neuroscience,11(2), 204-214. doi:10.1093/scan/nsv108

Li, R., Smith, D. V., Clithero, J. A., Venkatraman, V., Carter, R. M., & Huettel, S. A. (2017). Reasons Enemy Is Not Emotion: Engagement of Cognitive Control Networks Explains Biases in Gain/Loss Framing. The Journal of Neuroscience,37(13), 3588-3598. doi:10.1523/jneurosci.3486-16.2017

Venkatraman, V., Dimoka, A., Pavlou, P. A., Vo, K., Hampton, W., Bollinger, B. K., . . . Winer, R. S. (2014). Predicting Advertising Success Beyond Traditional Measures: New Insights from Neurophysiological Methods and Market Response Modeling. SSRN Electronic Journal. doi:10.2139/ssrn.2498095

Zak, P., Kurzban, R., & Matzner, W. (2005). Oxytocin is associated with human trustworthiness. Hormones and Behavior,48(5), 522-527. doi:10.1016/j.yhbeh.2005.07.009